All Categories

Featured

Table of Contents

- – Innovative Accredited Investor Secured Investm...

- – Next-Level Accredited Investor Financial Growt...

- – Market-Leading Exclusive Investment Platforms...

- – Best-In-Class Accredited Investor Financial G...

- – Groundbreaking Accredited Investor Real Esta...

- – High-Value Accredited Investor Alternative I...

- – Accredited Investor Passive Income Programs

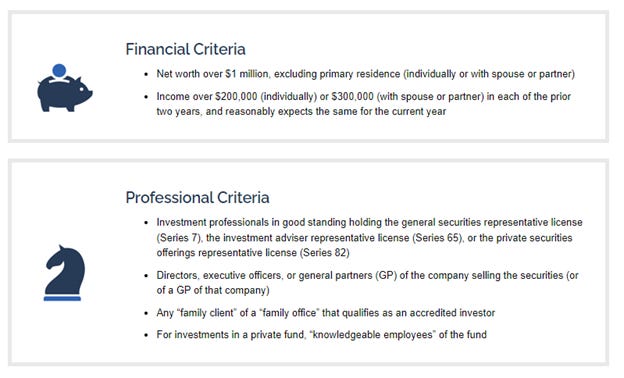

The guidelines for accredited capitalists differ among territories. In the U.S, the definition of a recognized investor is placed forth by the SEC in Guideline 501 of Policy D. To be an accredited capitalist, an individual has to have an annual revenue surpassing $200,000 ($300,000 for joint revenue) for the last 2 years with the assumption of gaining the same or a higher income in the current year.

This quantity can not include a key residence., executive policemans, or supervisors of a business that is issuing unregistered safeties.

Innovative Accredited Investor Secured Investment Opportunities for Exclusive Opportunities

If an entity consists of equity owners who are certified investors, the entity itself is a recognized capitalist. An organization can not be formed with the sole purpose of purchasing specific safety and securities. A person can certify as a recognized financier by demonstrating sufficient education and learning or work experience in the monetary sector

Individuals that want to be certified investors don't put on the SEC for the classification. Rather, it is the responsibility of the business offering a personal positioning to make certain that every one of those come close to are certified financiers. People or events who intend to be certified financiers can come close to the provider of the unregistered securities.

Mean there is an individual whose revenue was $150,000 for the last 3 years. They reported a key residence worth of $1 million (with a mortgage of $200,000), a cars and truck worth $100,000 (with an exceptional funding of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

This person's net worth is specifically $1 million. Given that they satisfy the net worth demand, they qualify to be a certified financier.

Next-Level Accredited Investor Financial Growth Opportunities

There are a couple of much less usual qualifications, such as managing a count on with greater than $5 million in properties. Under government safeties regulations, only those who are recognized financiers may join specific protections offerings. These might include shares in exclusive positionings, structured products, and private equity or hedge funds, to name a few.

The regulators wish to be certain that participants in these extremely dangerous and complex investments can look after themselves and judge the dangers in the absence of federal government defense. The certified financier regulations are made to shield possible financiers with limited economic expertise from dangerous ventures and losses they may be sick furnished to stand up to.

Approved investors satisfy certifications and expert standards to access special investment opportunities. Certified financiers must satisfy earnings and web worth needs, unlike non-accredited individuals, and can invest without restrictions.

Market-Leading Exclusive Investment Platforms For Accredited Investors

Some essential changes made in 2020 by the SEC include:. This adjustment identifies that these entity types are commonly used for making financial investments.

This change represent the results of rising cost of living gradually. These modifications expand the accredited capitalist swimming pool by about 64 million Americans. This bigger accessibility gives a lot more opportunities for financiers, but additionally enhances potential threats as much less monetarily innovative, investors can take part. Organizations utilizing private offerings might gain from a bigger swimming pool of possible financiers.

These financial investment options are special to accredited investors and institutions that certify as a certified, per SEC laws. This offers accredited financiers the chance to spend in emerging firms at a stage before they think about going public.

Best-In-Class Accredited Investor Financial Growth Opportunities with High-Yield Investments

They are watched as financial investments and come just, to qualified customers. Along with known companies, certified capitalists can choose to spend in startups and promising endeavors. This offers them tax obligation returns and the possibility to get in at an earlier phase and potentially gain benefits if the firm thrives.

For financiers open to the threats involved, backing startups can lead to gains (Accredited Investor Opportunities). Most of today's tech firms such as Facebook, Uber and Airbnb originated as early-stage start-ups sustained by recognized angel capitalists. Sophisticated capitalists have the opportunity to check out investment alternatives that might produce more earnings than what public markets offer

Groundbreaking Accredited Investor Real Estate Investment Networks

Although returns are not guaranteed, diversity and portfolio improvement options are increased for financiers. By expanding their portfolios with these increased investment methods recognized capitalists can enhance their methods and potentially achieve superior long-lasting returns with appropriate risk management. Skilled financiers often run into investment choices that may not be easily available to the general investor.

Financial investment options and safeties used to approved investors usually involve higher threats. For instance, exclusive equity, venture funding and bush funds commonly focus on purchasing properties that bring danger yet can be liquidated easily for the opportunity of greater returns on those high-risk financial investments. Researching prior to spending is important these in scenarios.

Lock up durations prevent investors from taking out funds for more months and years at a time. There is additionally far less openness and regulatory oversight of exclusive funds contrasted to public markets. Financiers might have a hard time to precisely value exclusive properties. When taking care of dangers certified capitalists need to assess any type of private investments and the fund supervisors entailed.

High-Value Accredited Investor Alternative Investment Deals

This modification may extend recognized investor condition to a variety of individuals. Upgrading the earnings and asset criteria for inflation to guarantee they reflect adjustments as time proceeds. The existing limits have actually stayed fixed because 1982. Allowing companions in committed relationships to incorporate their resources for shared qualification as recognized financiers.

Allowing people with specific specialist qualifications, such as Series 7 or CFA, to qualify as accredited investors. This would identify financial class. Producing additional requirements such as evidence of monetary proficiency or successfully finishing a recognized investor examination. This can ensure investors understand the dangers. Limiting or getting rid of the key residence from the internet well worth estimation to minimize potentially inflated evaluations of wealth.

On the various other hand, it can also lead to skilled capitalists presuming extreme dangers that might not be suitable for them. Safeguards might be needed. Existing recognized investors may encounter raised competitors for the very best investment possibilities if the pool expands. Firms elevating funds might benefit from an increased accredited capitalist base to draw from.

Accredited Investor Passive Income Programs

Those that are presently taken into consideration recognized investors must remain upgraded on any type of changes to the requirements and regulations. Organizations seeking certified capitalists need to remain watchful regarding these updates to ensure they are bring in the right audience of investors.

Table of Contents

- – Innovative Accredited Investor Secured Investm...

- – Next-Level Accredited Investor Financial Growt...

- – Market-Leading Exclusive Investment Platforms...

- – Best-In-Class Accredited Investor Financial G...

- – Groundbreaking Accredited Investor Real Esta...

- – High-Value Accredited Investor Alternative I...

- – Accredited Investor Passive Income Programs

Latest Posts

Property Tax Default List

Houses For Sale On Back Taxes

Foreclosure Overages

More

Latest Posts

Property Tax Default List

Houses For Sale On Back Taxes

Foreclosure Overages